Best Investment Apps for Beginners in 2025: Start Growing Your Money Today

Introduction

Starting your investment journey can be daunting, but with the right tools, it doesn’t have to be. The best investment apps for beginners make it easier than ever to dive into the world of investing, even if you have no prior experience. Whether you’re looking to grow your savings, plan for retirement, or just get started with stocks, these apps offer user-friendly features, low fees, and educational resources to help you succeed. In this post, we’ll explore the top investment apps of 2025 and guide you through choosing the one that’s right for you.

Getting started with investing can feel overwhelming, especially if you’re new to the world of finance. The good news? You don’t need a financial advisor or a large amount of money to begin. In 2025, there are plenty of beginner-friendly investment apps designed to simplify the process and help you grow your money—even if you’ve never invested before.

In this guide, we’ll walk you through the best investment apps for beginners, what makes them stand out, and how they can help you build wealth from your smartphone.

Investment apps have changed the game for new investors. They offer a low-cost, accessible, and simple way to enter the world of investing without needing to understand complex financial jargon.

Here’s why they’re ideal for beginners:

- User-friendly interfaces make navigation easy

- Low or no minimum deposits to get started

- Automated investing with robo-advisors

- Educational content built into the apps

- Fractional shares let you invest with just a few dollars

What to Look for in the Best Investment Apps for Beginners

When choosing the right app, consider your goals and comfort level. Not all investment apps are the same, and the best choice depends on what you need most as a beginner.

Here are key factors to consider:

- Ease of use: Look for apps with simple, intuitive design.

- Fees: Watch out for monthly or trading fees that can eat into your returns.

- Educational resources: These help you learn while you invest.

- Support options: Access to customer support or financial advisors is a plus.

- Types of investments available: Some apps focus on stocks, while others offer ETFs, crypto, or retirement accounts.

Why 2025 Is a Great Time to Start Investing

With inflation, rising costs of living, and the growing importance of financial literacy, now is a better time than ever to begin investing. Many of the best investment apps for beginners in 2025 offer features that cater specifically to those just getting started, helping you build strong financial habits early on.

Whether your goal is to save for retirement, buy a home, or just grow your money, these apps provide the tools to start with confidence.

Final Thoughts on the Best Investment Apps for Beginners

Choosing the right investment app is a crucial first step in your financial journey. The best investment apps for beginners offer a mix of ease, affordability, and educational support that make investing less intimidating and more accessible.

Start small, stay consistent, and remember—it’s not about timing the market, it’s about time in the market. With the right app, you’ll be on your way to financial growth in no time

Why Use an Investment App?

If you’re new to investing, getting started might seem complicated—but it doesn’t have to be. In fact, one of the easiest ways to begin is by using an investment app. Many of the best investment apps for beginners are designed to simplify the entire process, from setting up your account to making your first investment.

1. Easy to Use

Most investment apps have clean, user-friendly designs that make them easy to navigate—even if you’ve never invested before. You can view your portfolio, research stocks, and track performance with just a few taps on your phone.

2. Low Barriers to Entry

Traditional investing often required large upfront amounts. But today, many apps let you get started with as little as $1. That’s why the best investment apps for beginners include options for fractional investing—so you can buy a piece of a stock, even if you can’t afford a full share.

3. Automated Features

Don’t want to spend hours learning how to pick stocks? No problem. Many apps offer robo-advisors that automatically manage your investments based on your risk tolerance and goals. It’s investing made effortless.

4. Educational Resources Built In

A key reason why these are the best investment apps for beginners is the learning support. Many apps provide in-app articles, videos, and tips to help you understand what you’re doing. Some even offer personalized guidance or access to human advisors.

5. Everything in One Place

From checking your balance to making a trade or setting up recurring deposits, investment apps give you full control right from your smartphone. You can invest anytime, anywhere—which helps you stay consistent.

Final Thought

The best part? You don’t need to be a financial expert. The best investment apps for beginners make it simple, accessible, and even fun to take charge of your financial future. With low fees, helpful tools, and smart automation, investment apps remove the traditional barriers and put the power of investing in your hands

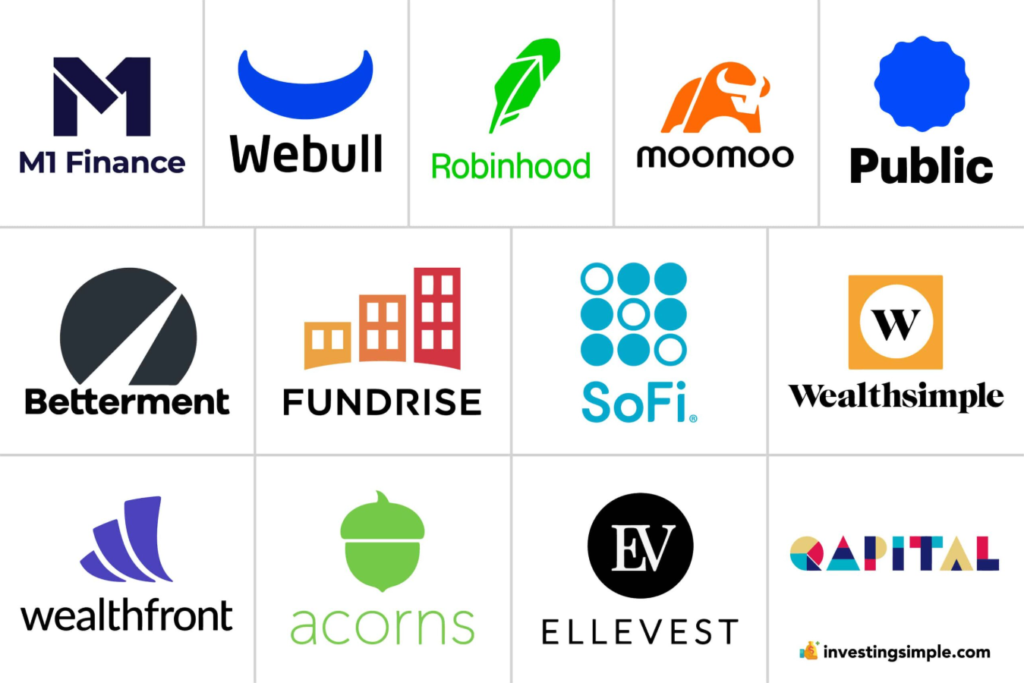

Top Investment Apps for Beginners to Try in 2025

With so many options available, choosing the right investment app can be overwhelming—especially if you’re just starting out. To make things easier, we’ve rounded up some of the best investment apps for beginners in 2025. These platforms are easy to use, packed with helpful features, and perfect for building your first portfolio.

Acorns

Best for: Passive investing and saving spare change

Acorns automatically rounds up your purchases and invests the spare change into a diversified portfolio. It’s perfect for beginners who want to invest without thinking about it too much.

- Pros: Hands-off investing, simple setup, good for building habits

- Cons: Monthly fee starting at $3/month

Robinhood

Best for: Commission-free stock and crypto trading

Robinhood is known for its simple, user-friendly design and no-fee trading. It’s a great entry point if you want to explore stocks and cryptocurrencies without paying commissions.

- Pros: No trading fees, intuitive interface, supports crypto

- Cons: Limited educational tools, not ideal for long-term investing

Stash

Best for: Learning while investing

Stash helps beginners understand investing by combining education with access to fractional shares. You can start with as little as $5 and follow investment themes you care about.

- Pros: Built-in educational tools, banking features included

- Cons: Monthly fees apply ($3 to $9/month)

Fidelity

Best for: Long-term investing with solid customer support

Fidelity offers a full-service experience with commission-free trades, retirement accounts, and robust research tools. It’s ideal for beginners who want room to grow.

- Pros: No fees, strong reputation, great resources

- Cons: More features can mean a steeper learning curve

SoFi Invest

Best for: All-in-one financial platform

SoFi combines investing, banking, budgeting, and even loan services into one app. It offers both active and automated investing with no commissions.

- Pros: Robo-advisor and self-directed investing, access to financial advisors

- Cons: Investment choices are somewhat limited

Bonus Mention: Public

Best for: Social investing and transparency

Public lets you follow other investors, see what they’re investing in, and even share your own trades. It also offers fractional shares and educational content.

- Pros: Social features, no commissions, clean interface

- Cons: Limited to stocks and ETFs (no retirement accounts)

Final Tip

While these are some of the best investment apps for beginners, the right app for you depends on your personal goals, budget, and learning style. The good news? Most of these apps let you start small—so you can try a few and see what feels right.The best investment apps for beginners make it simple to dive in, offering both the tools and the support to help you succeed. Whether you’re investing for the first time or looking to expand your knowledge, these apps provide everything you need to get started confidently and build wealth over time.

How to Choose the Right Investment App as a Beginner

With so many platforms available, it’s easy to feel overwhelmed when deciding which app to start with. The truth is, the best investment apps for beginners all offer something slightly different. The right choice comes down to your goals, comfort level, and what features matter most to you.

1. Know Your Investment Goals

Ask yourself: Why am I investing? Are you saving for retirement, looking to build long-term wealth, or just learning how the stock market works?

- If you want hands-off investing: Look for apps with automated portfolios or robo-advisors.

- If you want to learn as you go: Choose an app with strong educational content.

- If you’re curious about trading: Go for an app with stock and crypto access.

2. Check for Fees and Minimums

Some apps charge a monthly subscription fee, while others are completely free. Be sure to understand:

- Monthly or annual fees

- Commissions on trades

- Minimum deposit requirements

For beginners, low or no fees are ideal—so you can start investing without pressure.

3. Look for Beginner-Friendly Design

The best investment apps for beginners are easy to use. A clean interface, clear instructions, and helpful tutorials can make your investing experience much smoother.

- Apps should feel intuitive, not overwhelming.

- Look for features like guided setup, onboarding quizzes, or portfolio snapshots.

4. Consider the Types of Investments Offered

Not all apps offer the same investment options. Some focus on stocks and ETFs, while others include crypto, bonds, or retirement accounts (IRAs).

- Want long-term growth? Look for retirement-focused tools.

- Curious about crypto? Make sure the app supports digital assets.

- Want to invest in themes (like clean energy)? Try apps that support thematic investing.

5. Check for Learning Resources and Support

The best investment apps for beginners often include in-app guides, articles, videos, and sometimes even access to live financial advisors.

- Look for a “Learn” section, FAQ library, or chatbot support.

- Access to real-time help is a bonus, especially as you get started.

Final Thoughts on Investment Apps for Beginners

As a beginner, the idea of investing can seem daunting. But with the rise of best investment apps for beginners, it’s easier than ever to start your journey toward financial independence. These apps provide accessible, affordable, and easy-to-use tools that make investing not only possible but also enjoyable for those just starting out.

Get Started Today

The key takeaway is that there’s no better time than now to begin investing. Whether you’re looking to save for retirement, grow wealth, or simply learn about the stock market, the best investment apps for beginners offer everything you need to get started—from low fees to automated investing and educational resources.

Start Small, Stay Consistent

One of the most important lessons in investing is the power of consistency. You don’t need to start with large amounts of money. In fact, many of the top investment apps allow you to start with as little as $1. As a beginner, the goal should be to start small, learn, and then gradually increase your investments over time.

Choose the Right App for You

There is no one-size-fits-all solution. The best investment app for you will depend on your personal financial goals, risk tolerance, and learning preferences. Take the time to explore your options, read reviews, and consider the features that matter most to you—whether it’s automated investing, no fees, or access to educational content.

Stay Informed and Keep Learning

Remember, investing is a long-term game. With the best investment apps for beginners, you’ll have the resources you need to stay informed and educated throughout your journey. Whether it’s through in-app resources or external research, continuously learning about the market will help you make smarter investment decisions as you grow.

Final Thoughts

In conclusion, investing doesn’t have to be intimidating. The best investment apps for beginners make it simple to dive in, offering both the tools and the support to help you succeed. Whether you’re investing for the first time or looking to expand your knowledge, these apps provide everything you need to get started confidently and build wealth over time.

Conclusion

Conclusion: Start Growing Your Money Today with the Best Investment Apps for Beginners in 2025

As we move through 2025, the world of investing is evolving rapidly, making it easier than ever for beginners to start growing their wealth. With the help of investment apps, you can tap into powerful tools and strategies that were once only available to seasoned investors. The apps mentioned in this guide represent the best choices for those just starting out, offering user-friendly interfaces, low fees, and educational resources to help you understand the process and make informed decisions.

The Future of Investing is Accessible

Gone are the days when investing required large amounts of capital or insider knowledge. Today, anyone with a smartphone can start investing and building wealth—no matter their financial background. Investment apps have democratized access to markets, enabling beginners to invest in stocks, ETFs, cryptocurrencies, and even real estate with minimal barriers to entry.

The best investment apps for beginners in 2025 are designed with simplicity in mind. Whether you’re interested in passive investing through ETFs or more hands-on approaches like stock picking, these apps provide all the tools you need to get started. With easy-to-understand features like round-up investments, robo-advisors, and automated portfolio management, these platforms cater to users of all experience levels.

Start Small, Grow Big

One of the most attractive features of today’s investment apps is the ability to start small. Many apps now allow you to invest with as little as $1 or even fractional shares of expensive stocks like Tesla or Amazon. This means you don’t need to wait until you have thousands of dollars to invest—if you have a few extra dollars each month, you can begin building your portfolio today.

Over time, consistent small investments can compound, leading to significant returns. The magic of compound interest works best when you start early and stay consistent, and these apps are designed to help you stay on track by automating contributions, reinvesting dividends, and diversifying your investments.

Educate Yourself Along the Way

For beginners, one of the biggest barriers to investing is a lack of knowledge. However, many of the top investment apps now include educational resources that can teach you everything from the basics of stocks to more advanced concepts like options trading and market analysis. Some apps offer in-app tutorials, podcasts, blogs, and even one-on-one sessions with financial experts.

By investing time in learning, you can make more informed decisions, avoid common mistakes, and improve your overall investment strategy. Additionally, many apps offer financial planning tools that help you set goals, track your progress, and adjust your strategy as you go.

Security and Trust Matter

When it comes to handling your hard-earned money, security is paramount. The best investment apps prioritize your safety with encryption, two-factor authentication, and strong security protocols. These apps are often regulated by top financial authorities, ensuring that your funds are protected. It’s important to choose platforms that not only offer great tools and features but also have a track record of trustworthiness and reliability.

Take the First Step Now

The truth is, there’s never been a better time to start investing. Whether you’re looking to save for retirement, build wealth for the future, or simply explore new financial opportunities, the best investment apps for beginners in 2025 provide everything you need to succeed.

Start by choosing an app that aligns with your financial goals and risk tolerance. Invest at your own pace, educate yourself along the way, and most importantly—stay committed to growing your wealth.

The world of investing is at your fingertips, and with the right tools, you’ll be on your way to financial independence. Take the first step today, and let these investment apps be your guide to a brighter, wealthier future

other posts